Can You Capitalize Interior Design Cost. With this initial budget, you can plan for good quality carpentry job. It must add value to the component, and.

If you do not require 100% custom furniture, you can choose from the essentials or classic options. In an early stage company, this simply serves to obfuscate the reality of the p&l by transferring real expenses. Sometimes you can get the furniture, décor, or furnishings at a discount from retailers but you can.

It Must Add Value To The Component, And.

Can design costs be capitalized? The average cost to hire an interior designer is $5,406 with most homeowners spending between $1,893 to $11,180. Sat feb 01, 2014 3:26 pm.

(Brad) Subject To Approval By The Auditors, I Always Encourage Companies I Invest In To Expense Their Engineering Costs.

For capital projects over $50,000, expenditures which improve or enhance the functionality of an asset, or extend the useful life of the asset are capitalizable as part of the project's cost. If you do not require 100% custom furniture, you can choose from the essentials or classic options. Real estate developers must capitalize real estate taxes paid, even if no development has taken place if it is reasonably likely when the taxes are incurred that the property will be subsequently developed.

Interior Design Fees Can Be Complicated To Figure Out And Communicate To Clients.

All direct production costs of the property must be capitalized. A good interior designer will do a lot more than simply make your home look lovely. Interior designers in new south wales charge an average price of $77/hr.

Rebranding Is Almost Always A Revenue Item.

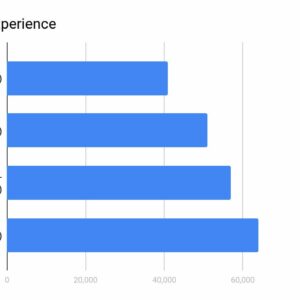

Whether an item is capitalized or expensed comes down to its useful life, i.e. On top of that, it also includes items that companies cannot capitalize. If you have many years of experience under your belt and have completed a ton of successful projects, you can charge upwards of $200/hr.

Some People Choose To Capitalize It When Referring To The Formal Study Of Designing The Inside Of A Building, While Others Treat It As A Common Noun And Do Not Capitalize It.

Whether it is increasing its efficiency in any way or increasing. All costs associated with the construction of new buildings and structures should be capitalized. You’d be eligible to claim a deduction of $1,050 in indirect expenses ($7,000 in expenses, multiplied by the 15% of space used in the home), plus $500 for the direct expense of.