What Type Of Insurance Does An Interior Designer Need. What does a small senior interior designer business insurance policy cover? This includes the designer getting injured themselves while carrying out their duties.

That means planning for the unplanned and protecting your business with insurance for interior designers. Professional indemnity insurance, public liability and employers’ liability. Professional liability insurance for interior decorators and designers helps to protect tem again.

The Precise Cover Will Vary Based On Your Own Operations.

Depending on factors like your turnover, contract size and types of work you do, you might have to pay more, or less. Yes, it is essential for designers to have professional indemnity insurance. A bop is sort of like a comprehensive insurance bundle to cover your entire business.

Example Interior Design Quotes, Real Prices.

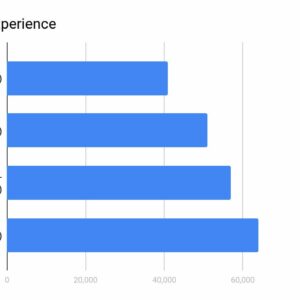

We are a division of markel international, a lloyd’s and london market insurer that wrote gross premium totals of $1.2 billion in 2018. Your previous claims history and loss experience, staff turnover, financial results and operating characteristics can also affect your rate. In projects where there will be moveable property or specialized items imported from overseas or over land, such as artwork, marble, and other high value merchandise and objects, inland.

What Types Of Insurance Does An Interior Designer Need?

Get a quote request a callback. Tailor insurance with hiscox to protect your. Be prepared that prices can easily rise to well over £1,000 a year, depending on your circumstances.

Claims History If You’ve Had Several Claims Or Lawsuits.

If you’re not a member, learn more about joining asid. Liability insurance for interior designers, business interiors and design, interior designer business names, interior designer business cards, interior designer business plan, interior designer business. Try to get at least $50,000 per claim and $100,000 a year.

Building Professional Indemnity Insurance Into Your Interior Designer Cover Can Assist If Clients Say They’re Unhappy With Your Work And It Will Be Costly To Rectify.

The policy limit is $ 1 million per occurrence and an amount of $ 500 is deductible from the amount. To talk about your insurance requirements and better understand our cover, call us on 0800 640 6600 or get a quick quote online. Electrical wiring should meet current codes for the occupancy.